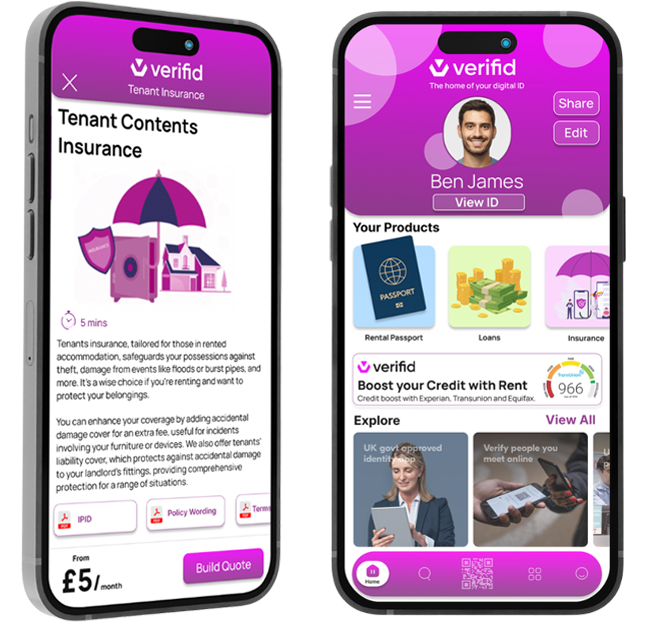

Our Verifid Services

Verifid is a digital identity platform built to remove the delays and repetition that get in the way of progress. Whether you are renting a home, applying for credit, or securing insurance, Verifid makes it faster and easier to prove who you are.

We begin with the rental journey, where identity checks are often the most frustrating. From there, our services expand into insurance, credit, and online verification across platforms. Every feature is connected by one goal: verify your identity once, and use it wherever trust is required.

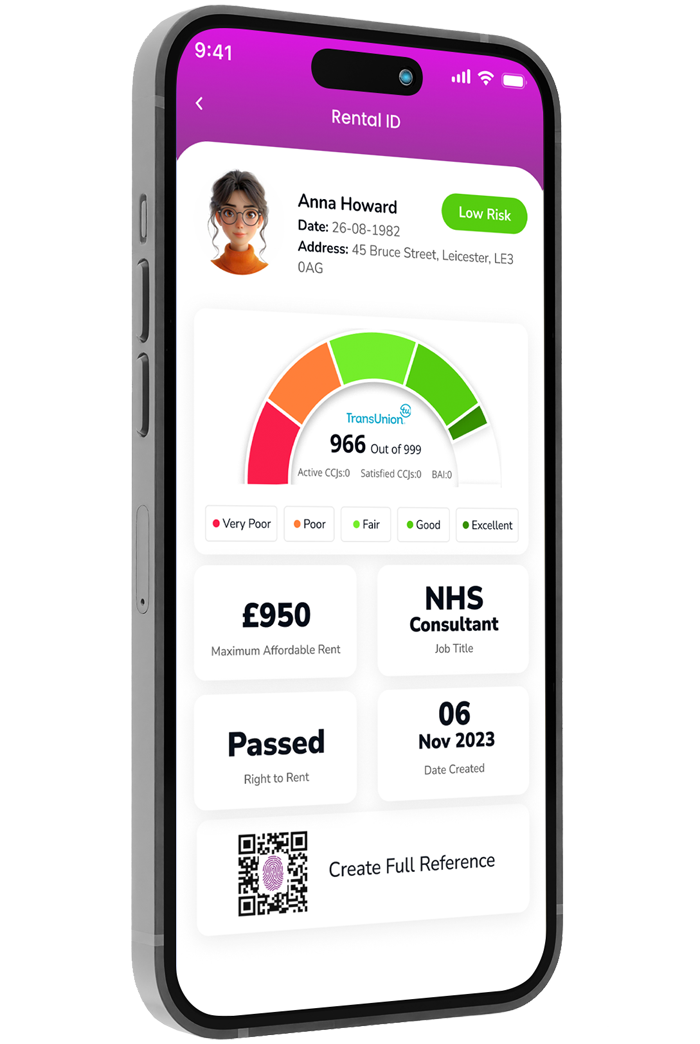

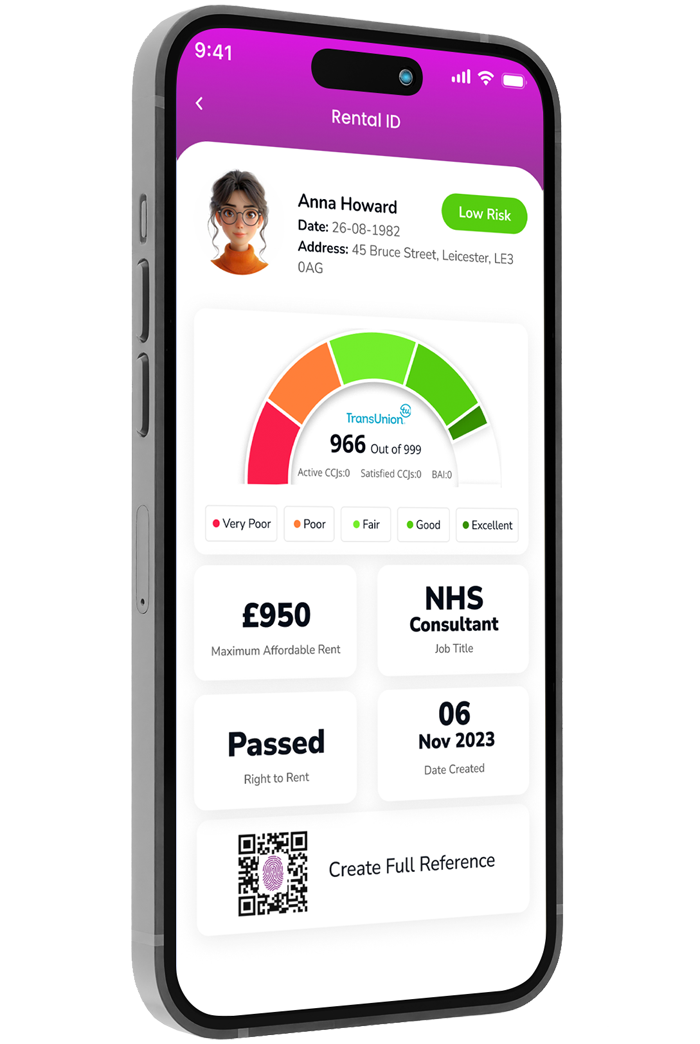

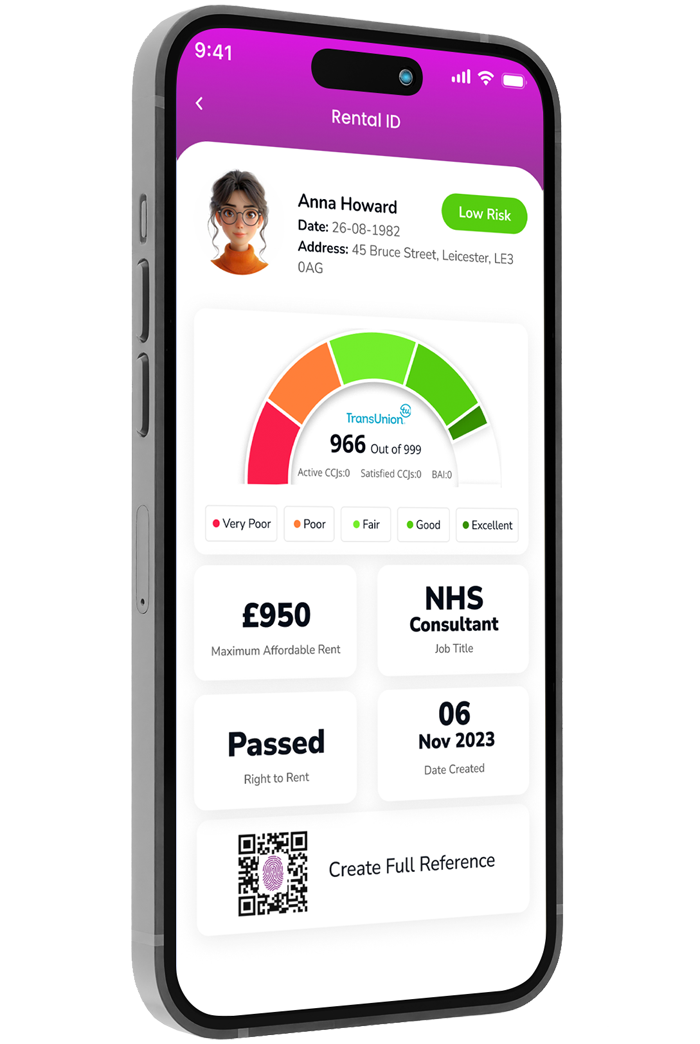

Verifid Rental ID

A digital identity you can use again and again.

Verifid Rental ID replaces the need to scan your passport, dig out utility bills, or send personal documents to multiple agents. Once verified, your identity can be securely shared with letting agents, landlords, or digital platforms. The process is simple and puts you in full control of your data. No repeat checks. No unnecessary steps. Just your identity, ready when you need it.

Full Tenant Referencing

A faster and more complete way to verify tenants.

Verifid provides a full referencing service that includes credit checks, affordability analysis, landlord references, and right to rent validation. It is built for speed, accuracy, and ease of use. Letting agents can manage referencing themselves or use our support team. The system also offers the option to connect referencing with rent guarantee insurance, improving trust on both sides.

Rent Reporting

Use your rent payments to improve your credit profile.

Rent reporting helps tenants build their credit by reporting on-time rent payments to major credit agencies. Once activated, the system runs automatically and works in the background. There are no credit cards or extra steps required. Just real credit improvement based on something you already do.

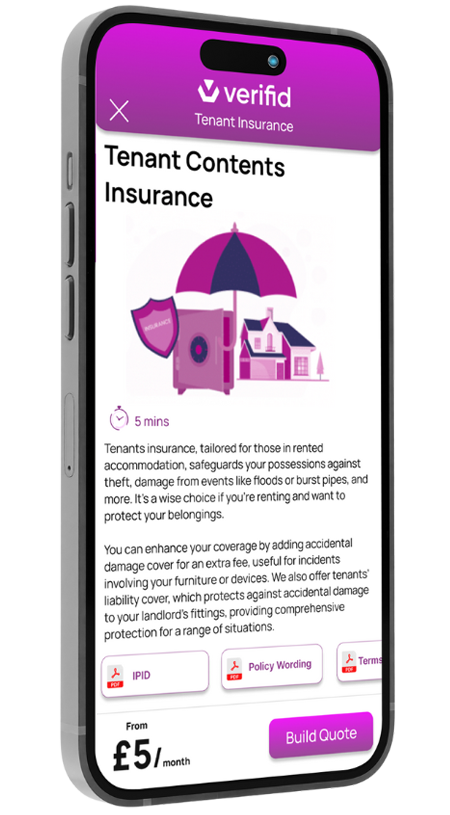

Embedded Insurance

Relevant cover when and where people actually need it.

Verifid offers contents, liability, and rent guarantee insurance through trusted partners. Offers appear at natural points in the rental or referencing process. There are no pushy sales tactics or unnecessary phone calls. Just straightforward protection presented clearly, when it is most helpful.

Smart Credit Offers

Access credit with confidence.

Verifid helps users find credit offers that are better suited to their verified financial profile. These include credit cards, personal loans, and credit builder tools. Each offer is personalised based on verified data, which increases acceptance rates and helps users make informed decisions.

Verifid API (ID-as-a-Service)

Let your platform verify users instantly and securely.

Our developer-friendly API allows CRMs, marketplaces, and digital platforms to plug directly into Verifid’s identity infrastructure. This enables real-time user verification, reduces fraud risk, and speeds up onboarding processes. The system is fully compliant with UK data standards, including GDPR and AML regulations.